Benefit cuts and a transport tax, such as paid parking, are among alternatives to GST being put forward by Policy & Resources.

With a week to go until the States resume the debate on tax reforms to raise revenue, P&R has put forward a new amendment.

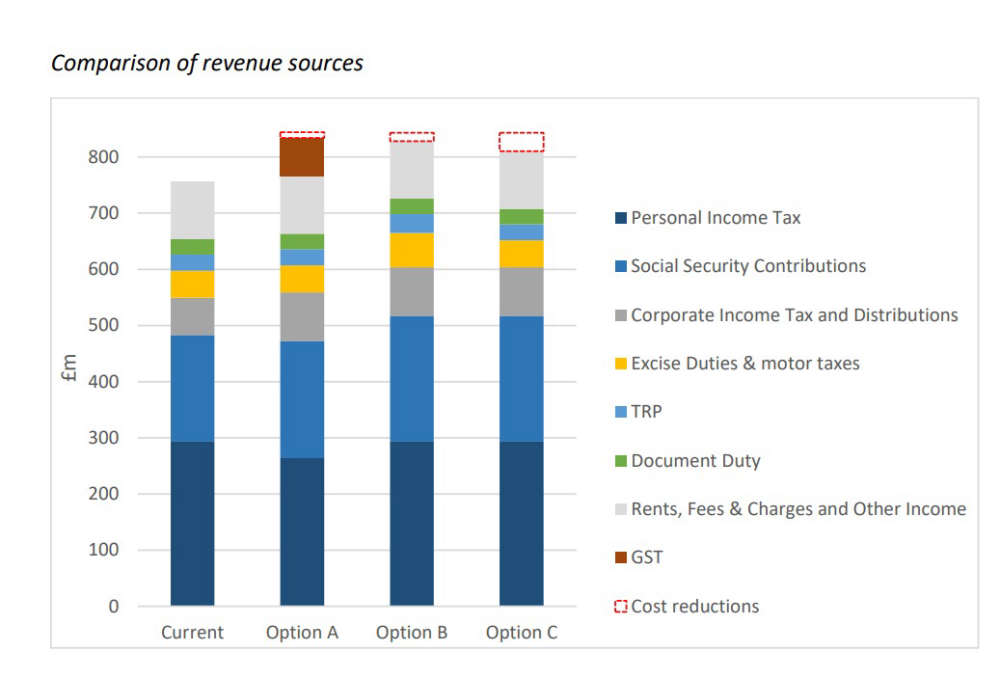

Deputies will have three options to choose from, which P&R says are capable of fixing Guernsey's financial deficit over time by around £85m.

Two of the options take the unpopular 5% Goods and Services Tax off the table, to reduce the risk of no decision being made.

P&R says leaving the island without a clear public finance plan past this point would lead to public services being cut - affecting the quality of life for Bailiwick residents.

The committee still believes its Option A is the best way forward, but P&R President Deputy Peter Ferbrache says supplying a fallback plan is important:

"It would be irresponsible of the senior committee of the States to not put forward alternative proposals which are credible. But we don’t think they are as good as the original proposals which could help address the situation.

If we don’t get a decision next week, whether it’s these proposals or any others, and we're just left with a general statement that says we've got a problem to solve, I don’t think I’ll be very good for Guernsey at all."

The options are as follows:

Option A is the committee's original proposal from November last year, which includes a 5% GST.

It would also introduce a 15% Income Tax band for everyone's income up to £30,000 and a £600 increase in the personal tax allowance.

The committee says it stills consider this package the most progressive and beneficial, despite the heavy opposition it has faced from the public, many politicians and several industry bodies.

Option B focuses on alternative revenue-raising measures without GST.

It looks to fill the financial deficit with additional taxes on transport and property - which could result in paid parking and a 50% increase in rates - TRP (tax on real property).

Higher social security contributions and benefit cuts - either reducing allowances or restricting eligibility.

Option C prioritises cost-cutting, shaving £31m off spending on public services.

Deputy Peter Ferbrache describes this option as "taking a hatchet and slashing public services."

"Guernsey cannot expect to have world-leading services in every area given our small size, but we do expect to have reasonable quality services in areas that most would agree are essential.

Those essential services are already strained and demand is rapidly growing, especially in healthcare. They would be severely damaged by such drastic cuts. I hope the States at the very least do not take us down that path.”

The States reconvene on 15 February to resume debate on tax reforms.

Parking to resume at the East Arm of Guernsey's main car park

Parking to resume at the East Arm of Guernsey's main car park

Guernsey's population is at its highest ever

Guernsey's population is at its highest ever

Cash reward for information following 'aggravated burglary' at Guernsey garage

Cash reward for information following 'aggravated burglary' at Guernsey garage

Gas bills to rise in Jersey and Guernsey

Gas bills to rise in Jersey and Guernsey