Profitable Perspectives: Fuelling Your Financial Progress with Diverse Investments

When you step into the arena of investments, diversity isn’t just a strategy; it’s a fundamental cornerstone of financial prosperity. Your financial journey shouldn’t be a game of roulette, betting on a single number and hoping for a fortune. Instead, it requires a thoughtful spread of assets across various sectors and forms, ensuring that you’re not just preparing for success but also cushioning any potential fallbacks. This article is your compass to navigate through the vast ocean of investment opportunities, from the pulsing heart of the stock market to the timeless lustre of gold and beyond.

You might have heard that the key to unlocking financial growth is investment, but it’s the artful selection of those investments that turns the key. As you read on, you’ll discover how diversifying your portfolio can not only protect your hard-earned money but also set the stage for a more robust financial future. And this isn’t about casting a wide, indiscriminate net – it’s about strategically placing your bets where they’re likely to do the best work for you.

The pursuit of financial progress is not for the faint-hearted. It demands diligence, adaptability, and a willingness to learn. As you embark on this expedition, arm yourself with knowledge and let your investments reflect your aspirations. The time to fuel your financial progress is now, and the way forward is through a diversity of investments.

The Power of Portfolio Diversification

Your investment portfolio is much like a team, where each player has a unique role that, when combined, aims for victory – your financial success. The concept of diversification is about building a team so balanced and well-rounded that if one player falters, the others can pick up the slack. By spreading your investments across different asset classes, you mitigate the risk of a single adverse event wiping out your entire financial game plan. Imagine you’re at a banquet with an array of dishes; if one doesn’t satisfy, plenty of others can delight your palate.

The strength of diversification lies in its ability to balance your exposure to risk. Just as a storm might ravage one part of the globe while the sun shines elsewhere, different investments often react in varying ways to the same economic event. This way, should the market take a downturn, you’re not left with all your dreams tied to a sinking ship. Instead, you have the potential to stay afloat and continue sailing toward your financial goals, thanks to the varied nature of your investments.

Navigating the Stock Market: Your Gateway to Growth

The stock market can be your playground for financial growth if you approach it with the right mindset. Think of it as a marketplace bustling with opportunities, where companies of all sizes offer a share of their future. By investing in a diverse range of stocks, you’re not just buying pieces of paper or digital numbers; you’re becoming part-owner of multiple ventures with the potential for substantial growth. But with great potential comes the need for strategic play, where research and patience are your most reliable allies.

As you align your sights with companies that show promise for a flourishing future, remember that the stock market rewards those who play the long game. It’s not about the adrenaline-fueled rush of short-term wins; it’s about positioning yourself in a way that lets compound interest work its magic over time. This requires staying informed, remaining vigilant, and not letting the ebbs and flows of daily market movements deter your steady course toward increasing your income.

Alternative Investments: Uncharted Waters of Opportunity

Venturing beyond the traditional landscapes of stocks and bonds, alternative investments invite you to explore potential growth in the most unconventional terrains. From the art on your walls to a stake in a budding enterprise, these types of investments can add a layer of excitement – and significant return potential – to your portfolio. They stand out, not just for their uniqueness but for their ability to march to the beat of their own drum, often unaffected by the fluctuations of the stock market.

However, with great reward often comes greater risk, and it’s crucial that you tread these waters with a clear-eyed view of what’s at stake. Venture capital and private equity, for instance, allow you to invest in companies before they hit the public market, offering a chance at outsized returns if they succeed. Collectibles, on the other hand, bring a sense of personal joy and can appreciate in value over time. While these investments can be more illiquid and require deeper due diligence, they represent a frontier of financial opportunity that can be both personally and financially fulfilling when approached wisely.

Investing in Gold and Commodities: A Timeless Treasure Trove

Gold’s enduring appeal as an investment is not merely about its lustre but its lasting value and stability in turbulent economic times. Physical Gold, a distinguished purveyor, offers investors a gateway to this traditional refuge by providing opportunities to buy gold coins. These tokens of wealth serve not only as a potential hedge against inflation but also as a testament to gold’s unyielding allure. For those in the UK, the option to buy gold coins marries the convenience of acquiring recognised assets with the security of knowing they hold a universally respected form of wealth.

Beyond the timeless glow of gold lies a spectrum of commodities that investors can tap into, from the industrial might of silver and platinum to the energy pulsating within oil and natural gas reserves. These commodities often dance to the rhythm of supply and demand, presenting opportunities for those who keenly observe the global economic theatre. Agricultural commodities like wheat, corn, and soybeans paint a picture of necessity and growth, offering another dimension to diversifying one’s investment portfolio. In essence, commodities represent the building blocks of the world, providing an investment canvas as broad as it is essential, allowing for strategic positioning that can both fortify and elevate an investment portfolio’s performance over time.

Technology and Investments: The Digital Frontier

In an age where technology reshapes landscapes at breakneck speed, the investment world is no exception. The advent of fintech has democratised access to markets, making it easier than ever for you to manage your portfolio with a few taps on your smartphone. From robo-advisors crafting personalised portfolios to platforms providing real-time data and analysis, technology empowers you to make informed decisions with efficiency and precision.

Embracing these tools doesn’t just streamline your investment process; it can enhance your understanding of the market’s inner workings. With the right technological resources at your disposal, you’re equipped to make decisions that align with your financial vision. This digital empowerment is not a mere luxury but a crucial component of modern investing that you can leverage to fuel your financial progress.

Creating a Strategy: Your Map to Treasure

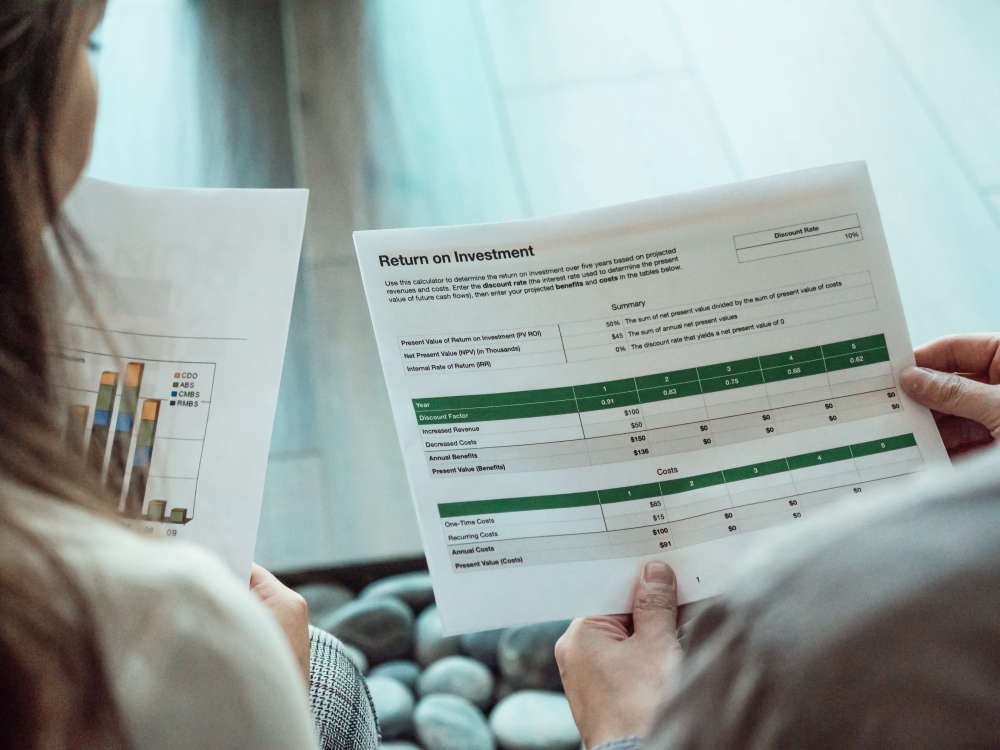

Embarking on an investment journey without a map can lead to unintended destinations. That’s why crafting a personalised investment strategy is crucial – it’s the map that guides you to your treasure, the financial future you aspire to. Your strategy should reflect your financial goals, risk tolerance, and investment timeline, serving as a blueprint that navigates through market noise and guides your decision-making.

Drawing up this map involves assessing where you are today, where you want to be tomorrow, and the investment routes that will get you there. It’s about setting clear objectives, whether it’s building passive income, increasing your wealth, or saving for a specific goal, and then aligning your investment choices to this vision. With a solid strategy in place, you can approach the investment landscape with confidence, adaptability, and clarity that every step you take is a step closer to your financial aspirations.