A Guernsey accountant who works with new and small firms says opening business accounts is becoming a problem.

The Guernsey Chamber of Commerce published a report recently on the issues surrounding non finance firms accessing banking services.

Although not a Chamber member, Tim Chilestone recognises through his contact with clients, that for some small businesses in Guernsey, it's difficult:

"Banking for businesses in Guernsey is becoming a crisis. It's becoming increasingly frustrating to even attempt to apply for a business account. It's taking many, many weeks after people apply to even then be told that potentially they don't qualify. They're running into roadblocks."

He says the wait to open a new account is one of the barriers:

"It can take 12 to 16 weeks to open an account. And that means that you have issues not being able to bank cash that you've taken, not being able to receive credit card payments because you need a bank account for those to to go into."

He says the banks offer a variety of reasons for the delay in opening accounts, or sometimes a refusal to:

"The common theme is 'oh we don't open accounts here any more, it's all done in Jersey, the Isle of Man or the UK.' Also, 'oh because of Covid, we're short of staff and have got a backlog.'"

Tim says it may be time for the States to intervene:

"They need to look at mandating that the banks provide, or providing themselves, maybe through Guernsey Post, even just a basic business account. It doesn't need to be complex, it just needs the basic ability to receive funds and distribute funds."

We have contacted the Association of Guernsey Banks and GIBA for a response on behalf of the banking industry.

Team Guernsey gets Island Games send-off

Team Guernsey gets Island Games send-off

Permission given for 69 homes on CI Tyres site

Permission given for 69 homes on CI Tyres site

Members chosen for Guernsey's top political committee

Members chosen for Guernsey's top political committee

Redundancies at Guernsey Post

Redundancies at Guernsey Post

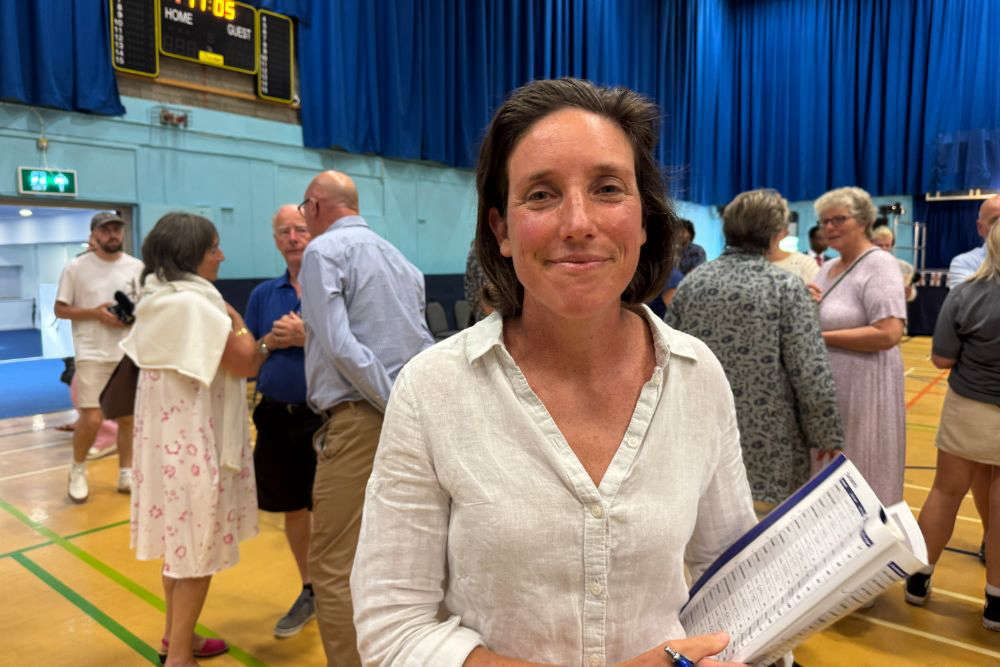

Guernsey gets first woman Chief Minister

Guernsey gets first woman Chief Minister

Who will be Guernsey's next Chief Minister?

Who will be Guernsey's next Chief Minister?

Teen jailed for sending explicit messages to children

Teen jailed for sending explicit messages to children

New website to catalogue Guernsey States work

New website to catalogue Guernsey States work