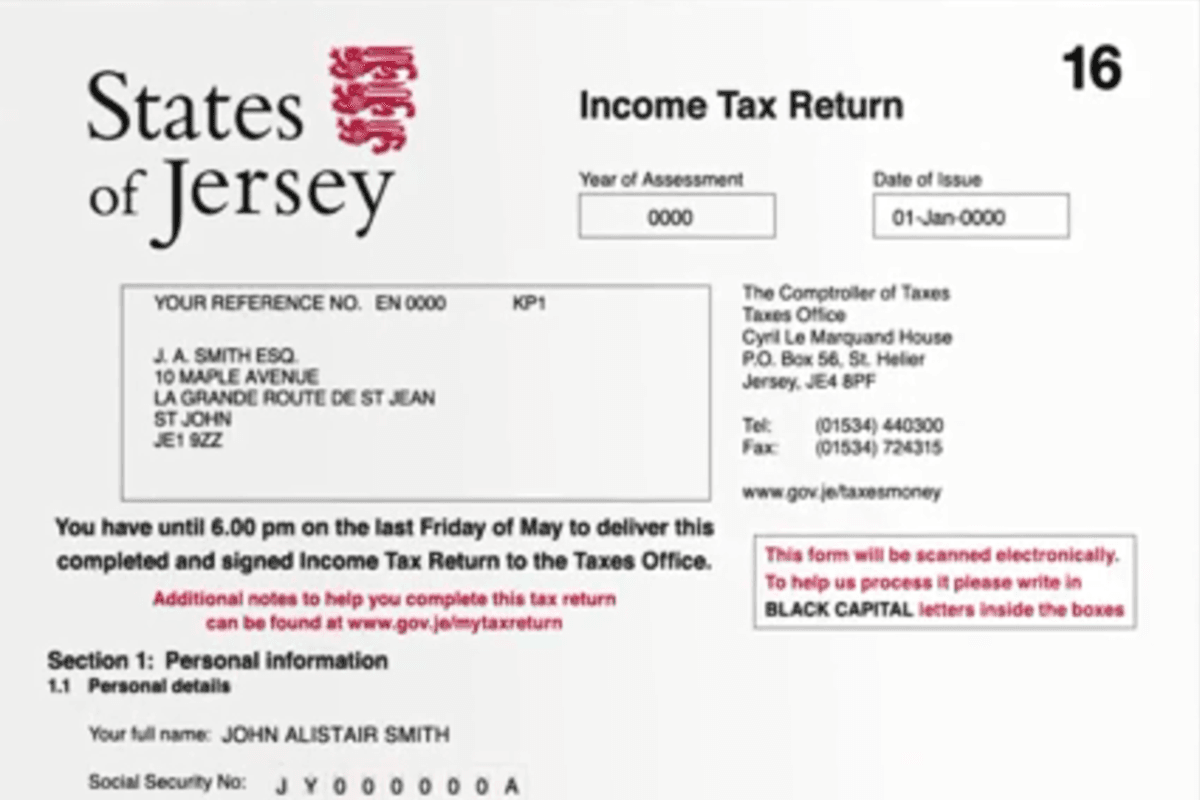

Two thirds of islanders could be paying less Income Tax from 2020.

That’s according to Reform Jersey, which has lodged an amendment to next year’s Budget promising to make taxes simpler and fairer.

In May’s General Election, Jersey’s only political party pledged to move to one tax calculation, reduce the marginal rate and allow all taxpayers to claim allowances.

Their Chairman, Senator Sam Mezec, has lodged an amendment which would see the current ’20 means 20′ tax rate calculation scrapped.

If States Members back the plans, the top 5% of earners would pay more and two thirds of islanders taxed less.

Senator Mezec says it would generate an extra £7.5 million every year, as well as reducing strain on middle earners:

“During the election, we pledged that if our members were elected, we would aim to make the Income Tax system simpler and fairer to reduce inequality. We believe the States needs to take action to deliver on our commitment to improving the standard of living for Islanders, and hope that members will be persuaded by our proposal to put more money in the pockets of ordinary Islanders, whilst asking those who have the broadest shoulders to carry more of the burden.

“Our proposals have been independently verified by the Treasury Department, who have confirmed that this would raise an extra £7.5m in revenue per year, which we would want to see invested back in our public services.”

Politicians will debate the proposals during the States sitting on December 4th.

Jury finds Shay John Bester guilty of offences including rape

Jury finds Shay John Bester guilty of offences including rape

African community groups express 'disappointment' with Deputy Ozouf sentencing

African community groups express 'disappointment' with Deputy Ozouf sentencing

Island Energy to return to Royal Court over Mont Pinel gas explosion

Island Energy to return to Royal Court over Mont Pinel gas explosion

Jersey to introduce legal limit for PFAS in drinking water

Jersey to introduce legal limit for PFAS in drinking water

Jersey Electricity drops St Martin solar farm idea

Jersey Electricity drops St Martin solar farm idea

PPC won't move to block Deputy's return to States Assembly

PPC won't move to block Deputy's return to States Assembly

Jersey's next government urged to create laws preventing exploitation of workers

Jersey's next government urged to create laws preventing exploitation of workers

Philip Ozouf sentenced to 120 hours community service

Philip Ozouf sentenced to 120 hours community service

Comments

Add a comment