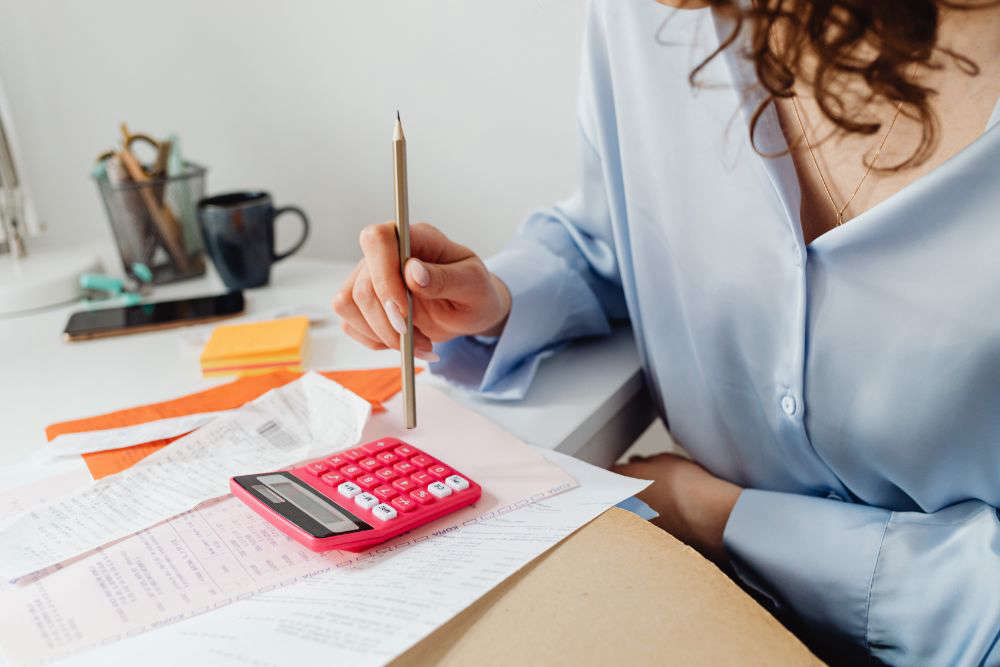

Mortgage lenders and Ministers are being urged to get together and discuss how they can support homeowners in Jersey.

Reform Jersey Deputy Geoff Southern has put forward a proposition asking the Chief Minister to meet with lenders and find ways to ease the pressure on households from rising interest rates.

Deputy Southern wants lenders to allow borrowers to extend their mortgage term or switch to interest-only repayments to reduce their monthly bills.

He also wants repossessions to be banned for 12 months after the first missed payment.

Similar measures were announced by the UK government, labelled the Mortgage Charter.

Deputy Southern thinks Jersey is behind the curve.

"I noticed that the Conservative government in the UK where talking with mortgage lenders and credit providers.

And that's when it became clear to me that our government weren't doing anything like that. There was no mention of help for homeowners - we were just plodding on."

Last week (22 June) the Bank of England made its 13th consecutive increase to the base rate, which now sits at 5%.

That makes borrowing money more expensive and means payments on mortgages, credit cards and loans will be higher.

85% of UK lenders signed the 'Mortgage Charter', Deputy Southern believes there will be a similar uptake here.

"The conditions and the house prices in Jersey are worse than that in London and the South East of England.

I would expect a reasonable conversation between the government and mortgage lenders would produce a similar set of results."

The proposition will be debated in July.

Wonky Town 2026 is cancelled

Wonky Town 2026 is cancelled

'Design code' being drawn up for Gorey Pier

'Design code' being drawn up for Gorey Pier

Jersey philanthropist remembered as a 'truly remarkable man'

Jersey philanthropist remembered as a 'truly remarkable man'

Channel Islanders in the Middle East told to follow local warnings

Channel Islanders in the Middle East told to follow local warnings

Channel Islands mobile portability issues to be resolved soon

Channel Islands mobile portability issues to be resolved soon

LibertyBus fares increase 8% for adults and 10% for children

LibertyBus fares increase 8% for adults and 10% for children

Jersey could be back in rugby national leagues

Jersey could be back in rugby national leagues

'No-fault' divorces allowed after 'long overdue' law change

'No-fault' divorces allowed after 'long overdue' law change