Loans of between £5,000 and £500,000 are being offered in a new Jersey government-backed scheme to help local businesses affected by the coronavirus pandemic.

The 'Loan Guarantee Scheme' will be operated through clearing banks who lend to island firms, to give them more financial support as the crisis deepens.

It has been agreed in coordination with the governments of Guernsey and the Isle of Man.

Jersey's Economic Development Minister announced it as part of an initial £180m package of measures for firms facing disruption because of the Covid-19 outbreak.

Senator Lyndon Farnham later unveiled a further £100m pay-roll co-funding scheme, covering 80% of workers' salaries up to a maximum value of £1600 a month.

The Minister said it would benefit around half the island's workforce (around 27,000 people). But some sectors among a list of 20 excluded from the subsidies have complained about a lack of help for them.

On Monday, the Minister said officers would be revisiting the list and reviewing the offer in light of developments that have forced more business closures.

Jersey Business is offering guidance to firms needing help to prepare an application for the Loan Guarantee Scheme, although those with an existing relationship manager within their bank should contact them in the first instance.

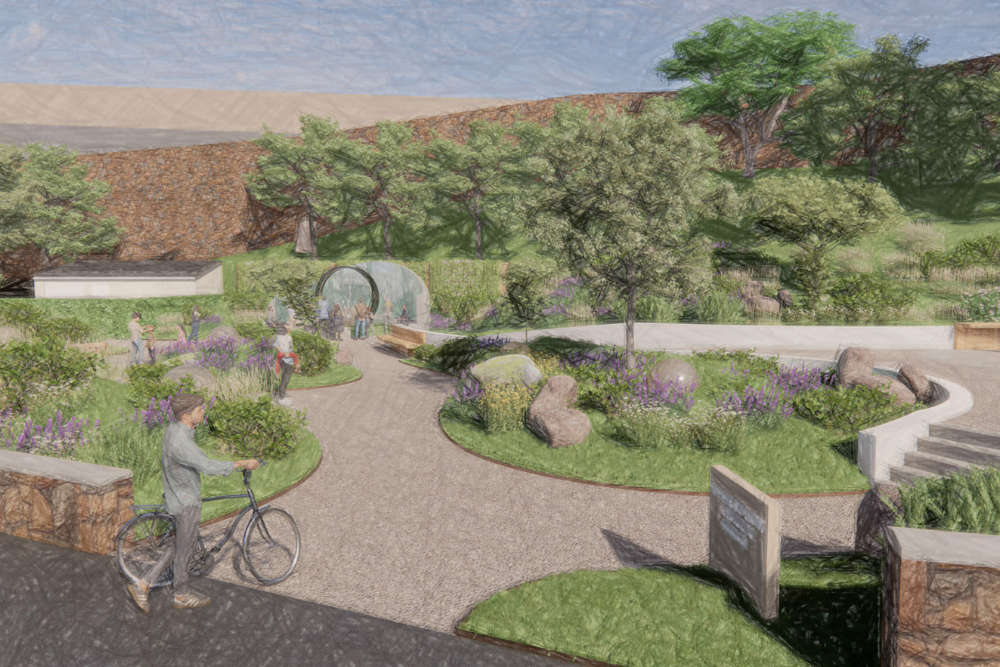

Work begins on Haut du Mont Memorial Garden

Work begins on Haut du Mont Memorial Garden

Inflation in Jersey at 2.8%

Inflation in Jersey at 2.8%

Review rules out benefits overlap for pensioner carers

Review rules out benefits overlap for pensioner carers

Ignoring data protection may cause Jersey to 'lose our economy'

Ignoring data protection may cause Jersey to 'lose our economy'

Draft law scraps time limits on abortions in Jersey

Draft law scraps time limits on abortions in Jersey

Divide over approach to gender guidance in schools

Divide over approach to gender guidance in schools

Three charities awarded £500 grants in community campaign

Three charities awarded £500 grants in community campaign

Ministers back principle of social media 'restrictions' for under 16s

Ministers back principle of social media 'restrictions' for under 16s

Comments

Add a comment