EY has been appointed to do a £200,000 review of Guernsey's corporate tax options.

It is part of work to find how best to raise an extra £85 million a year to plug a shortfall in public finances.

Policy and Resources has appointed EY to look at new ways to generate money from local businesses, saying they need to make sure whatever they introduce doesn't put off employers or affect jobs for islanders.

"EY were appointed because they can offer locally-based professionals with an excellent understanding of the Islands and the situation they currently face, together with global EY expertise in tax policy, economics and a deep understanding of the current international tax framework." - States of Guernsey statement.

The committee delayed a Stated debate on tax options until the last quarter of this year.

It was due to be held in July and include the controversial suggestion of bringing in a Goods and Services Tax (GST)

P&R said the delay until the autumn or winter would also allow more evidence to be gathered from the ongoing review into population and immigration.

EY will report back in the summer

Flu cases in Guernsey 'creeping up'

Flu cases in Guernsey 'creeping up'

CI ferry operators to work together to improve inter-islands travel

CI ferry operators to work together to improve inter-islands travel

Talks ongoing to enable Guernsey ferries to access St Malo

Talks ongoing to enable Guernsey ferries to access St Malo

"No shortage" of flu jabs for Guernsey vaccination programme

"No shortage" of flu jabs for Guernsey vaccination programme

Both winning CI Christmas Lottery Tickets sold in Jersey

Both winning CI Christmas Lottery Tickets sold in Jersey

Guernsey women's murder trial "unlikely ever to resume"

Guernsey women's murder trial "unlikely ever to resume"

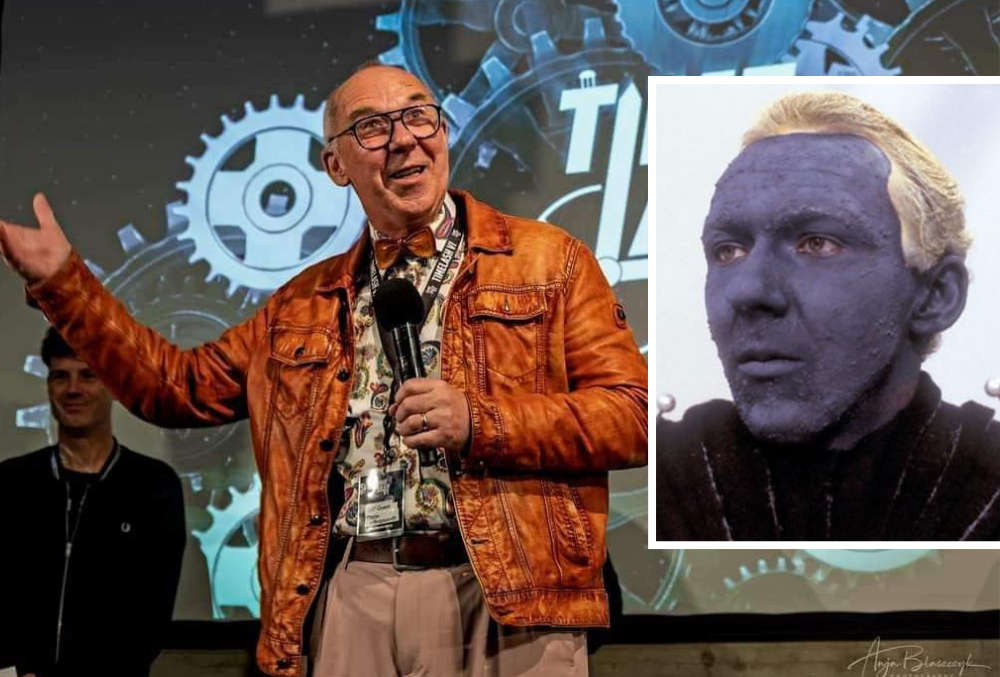

Guernsey actor to reprise Doctor Who role for Boxing Day Dip

Guernsey actor to reprise Doctor Who role for Boxing Day Dip

Aurigny to fly between Guernsey and Jersey next year

Aurigny to fly between Guernsey and Jersey next year