The government's 2026 Budget proposes cheaper pints in Jersey pubs, more free nursery places, and a new vaping tax.

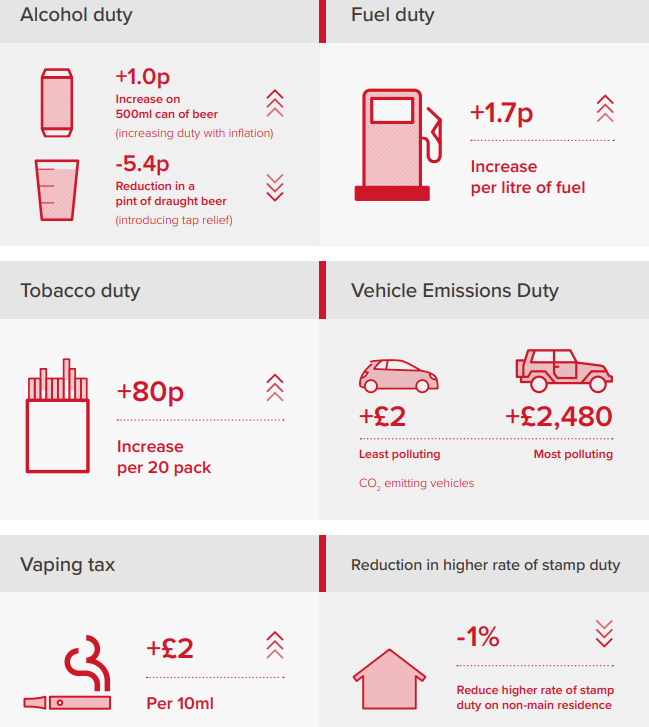

The £2 per 10ml duty on vapes aims to tackle the growing trend of young people using e-cigarettes.

The government believes creating a tax on the product will help to deter children trying it, but still allow smokers the choice of using vapes to quit their cigarette habit.

Recent data revealed more than half of adults aged 16-to-34 had tried e-cigarettes once or twice. A ban on the sale of single-use vapes was introduced in August 2025.

Other budget measures include 80 pence on a packet of 20 cigarettes and 1.7p on a litre of fuel.

Drinkers can perhaps look forward to cheaper draught drinks from the new year, with a 5.4p cut in the duty on a pint in the pub - a so-called 'tap relief'.

The government has made the move to help the island's struggling hospitality sector.

Treasury Minister Deputy Elaine Millar says it will reduce the price of drinking 'out':

"It will cover beer, cider, wine, pre-mixed cocktails that are bought in big containers and sold that way."

However, the duty on canned drinks will increase, with an extra penny on 500ml of beer.

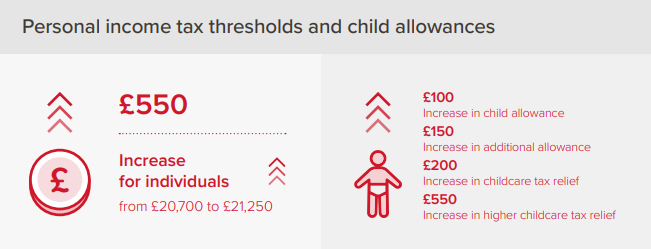

Workers won't pay tax on the first £21,250 of their income, with a £550 increase proposed in the income tax threshold.

Chief Minister Lyndon Farnham told Channel 103 90% of taxpayers will benefit from £9 million-worth of relief and allowances as part of measures to help with the cost of living.

Treasury Minister Elaine Millar says it will particularly help those on lower incomes:

"The tax allowance increase means that people keep more of the money they earn. It keeps money in people's pockets. They can choose how they spend that.

"We have one of the most generous tax allowances of neighbouring jurisdictions - way more than the UK and Guernsey."

Free nursery places will be offered to two and three year olds using £3m to expand Early Years provision.

Ministers say the main focuses of their budget plans are health care, children's services and the recently- announced 'Investing in Jersey' capital fund.

READ: £80m per year plan to invest in Jersey's infrastructure

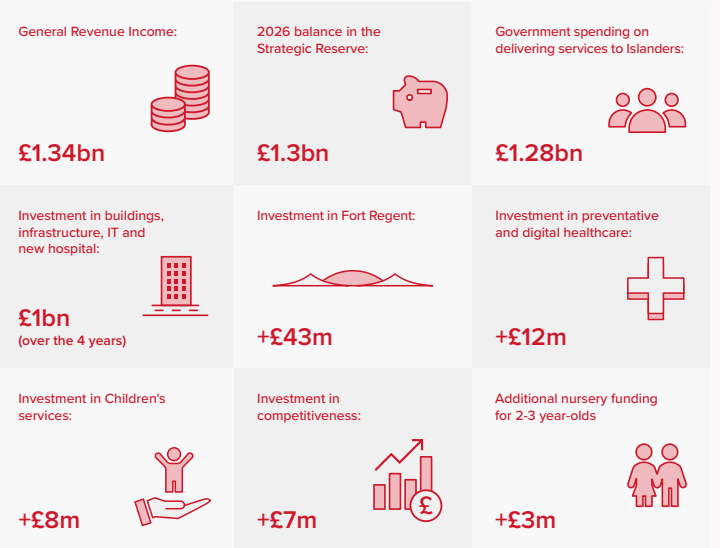

A total £1 billion will be spent on capital programmes between 2026 and 2029, to renew key public assets. Capital spending for 2026 will be £308m.

This includes £174m for the new hospital, which will start being built later this year.

An extra £12 million will go on preventative care and digital health initiatives.

The capital investment fund will create a dedicated pot for long-term projects, including new homes, schools, a replacement Highlands College campus, and sea defences.

£43m will go towards overhauling Fort Regent to create a premier leisure destination.

READ: Rooftop bar, climbing wall and concert hall in £110m Fort Regent plans

In total, government spending on public services will run to £1.28bn in 2026, including £381m on Health and £246m on Education. Ministers say they will make £9m in savings by cutting layers of management and the use of consultants, as well and consolidating office space.

Deputy Farnham said:

"By streamlining government operations and supporting our economy, from digital healthcare to maintaining a competitive finance sector, Jersey is well positioned to respond to current pressures while building a secure and prosperous future."

These are the last tax and spend proposals from the current executive before next June's general election.

The budget will be debated by the States Assembly in their sitting starting 9 December.

Jury finds Shay John Bester guilty of offences including rape

Jury finds Shay John Bester guilty of offences including rape

African community groups express 'disappointment' with Deputy Ozouf sentencing

African community groups express 'disappointment' with Deputy Ozouf sentencing

Island Energy to return to Royal Court over Mont Pinel gas explosion

Island Energy to return to Royal Court over Mont Pinel gas explosion

Jersey to introduce legal limit for PFAS in drinking water

Jersey to introduce legal limit for PFAS in drinking water

Jersey Electricity drops St Martin solar farm idea

Jersey Electricity drops St Martin solar farm idea

PPC won't move to block Deputy's return to States Assembly

PPC won't move to block Deputy's return to States Assembly

Jersey's next government urged to create laws preventing exploitation of workers

Jersey's next government urged to create laws preventing exploitation of workers

Philip Ozouf sentenced to 120 hours community service

Philip Ozouf sentenced to 120 hours community service